News

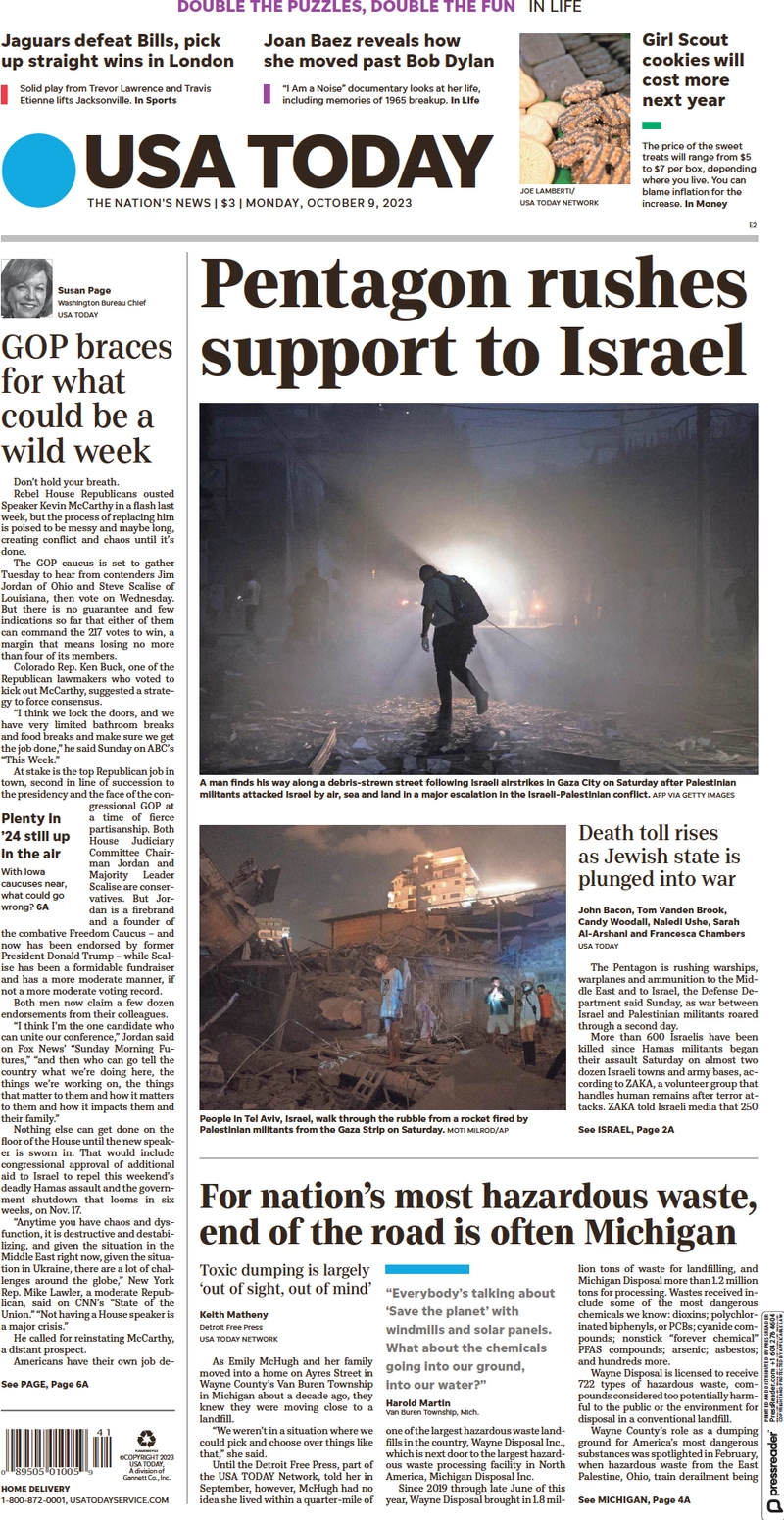

U.S. sends aircraft carrier to support Isreal

U.S. Defense Secretary Lloyd Austin announced Sunday that he has ordered American military ships, including an aircraft carrier and additional aircraft, to move closer to the eastern Mediterranean in response to Hamas’ unprecedented, multi-fronted attack on Israel.

At least four U.S. citizens were among the more than 700 people killed in Israel amid Hamas assault, according to a Sunday night statement from Senate Majority Leader Chuck Schumer.

“Today, in response to this Hamas attack on Israel, and following detailed discussions with President Biden, I have directed several steps to strengthen Department of Defense posture in the region to bolster regional deterrence efforts,” Austin said in a news release.

The USS Gerald R. Ford Carrier Strike Group includes the USS Gerald R. Ford aircraft carrier, which is the largest warship in the world, in addition to the Ticonderoga-class guided missile cruiser USS Normandy and four Arleigh-Burke-class guided missile destroyers — USS Thomas Hudner, USS Ramage, USS Carney and USS Roosevelt.

The USS Gerald R. Ford was in the western Mediterranean when it received orders to deploy. Depending on its precise location, it could have to travel over a thousand miles.

Austin also announced steps to augment U.S. Air Force fighter aircraft squadrons in the region. USAF aircraft are going into bases in the Middle East where they will be available for operations against Iran.

The munitions the U.S. will be sending over are being airlifted.

Austin spoke with Israeli Defense Minister Yoav Gallant on Sunday “to express support for the people of Israel and to receive updates on Israel’s operation to restore security and safety from Hamas’ terrorist attack,” Pentagon press secretary Brig. Gen. Pat Ryder said in a statement.

Gallant and Austin will “remain in close contact in the days and weeks ahead,” Ryder added.

The announcement came shortly after the White House confirmed that President Biden and Israeli Prime Minister Benjamin Netanyahu spoke again Sunday morning. The two leaders discussed Hamas’ taking of Israeli hostages, with Mr. Biden assuring Netanyahu that U.S. assistance for the Israel Defense Forces was on its way to Israel, with more to follow over the coming days.

ANDREJ TARFILA/SOPA IMAGES/LIGHTROCKET VIA GETTY IMAGES

“The President emphasized that there is no justification whatsoever for terrorism, and all countries must stand united in the face of such brutal atrocities,” the White House readout of the call said.

“President Biden updated the Prime Minister on the intensive diplomatic engagement undertaken by the United States over the last 24 hours in support of Israel,” the readout added.

Austin confirmed that the first movement of U.S. security aid to the IDF will begin moving Sunday and arrive in the coming days.

“My team and I will continue to be in close contact with our Israeli counterparts to ensure they have what they need to protect their citizens and defend themselves against these heinous terrorist attacks,” Austin said.

Israeli officials said early Monday that over 700 Israeli civilians and members of the military had been killed since Hamas launched its unprecedented attack on Israel from the Gaza Strip early Saturday morning. Another 2,150 were wounded.

The Gaza Ministry of Health said Monday that more than 400 Palestinians had been killed and 2,200 more wounded in Israel’s retaliatory strikes on Gaza since Saturday.

Many Israelis, both civilians and security forces, have been taken hostage. Israeli ambassador Michael Herzog said on “Face the Nation” on Sunday that he was under the impression there were Americans taken hostage, but he didn’t have details. U.S. Secretary of State Antony Blinken said on “Face the Nation” that the U.S. investigating reports that Americans were among those taken hostage.

There is not yet any serious planning for the evacuation of American citizens, U.S. officials said.

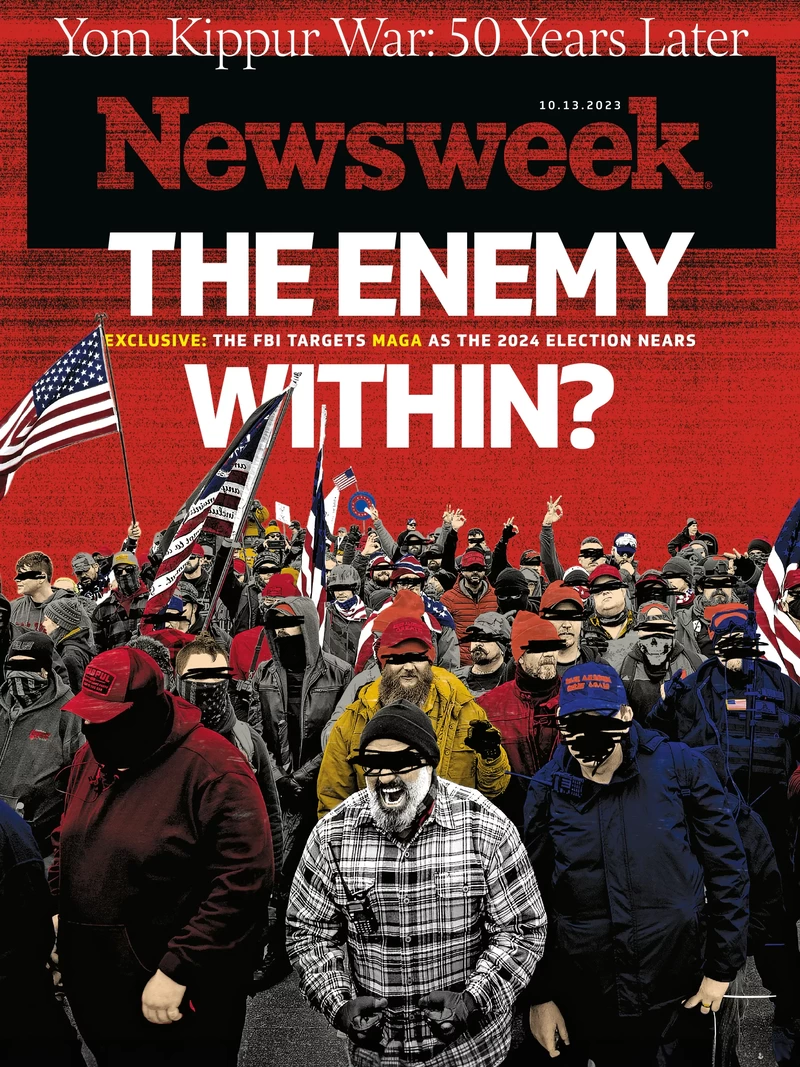

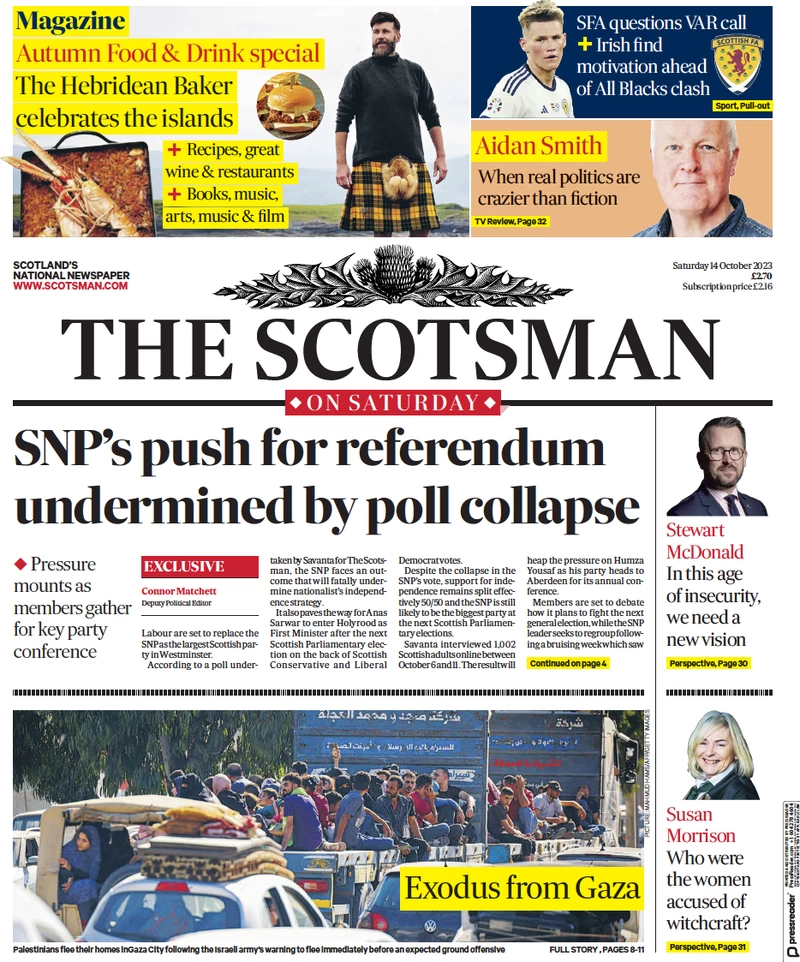

Front Pages || October 9, 2023

Moody’s: Islamic Banking Industry Remains Underdeveloped In Africa

Despite having around 28 per cent of the world’s Muslim population, Africa’s Shariah compliant banking assets make up only around two per cent of global Islamic banking assets, Moody’s Investors Service has said.

A report issued Thursday by the rating agency, stated that African Islamic banks face obstacles to growth, including high level of competition from conventional banks in some countries and a lack of product awareness in some other jurisdictions.

While the industry’s na- scent legal and regulatory landscape has been among the constraints, there is noticeable progress now being made in jurisdictions such as Morocco, Nigeria and across the West African Economic and Monetary Union (WAEMU), the report said.

“The Islamic banking industry remains underdeveloped in Africa as product awareness and sector competitiveness lag domestic conventional peers in some countries. However, legal, regulatory and tax frameworks are progressing well in some jurisdictions,’’ said Mik Kabeya, Vice President, Analyst at Moody’s.

Septimus ‘Bob’ Blake resigns as president of Jamaica Bankers Association

The Jamaica Bankers Association (JBA) today announced the resignation of Septimus ‘Bob’ Blake as president of the association, with effect on Friday, September 29.

“Mr Blake has been a dedicated and visionary leader during his tenure and his departure marks the end of a chapter filled with formidable contributions to the development of the Jamaican banking sector,” the association said in a press release today.

“Under Mr Blake’s leadership, the JBA made significant strides in its advocacy for the interests of its member organisations and other stakeholders within the industry. His fostering of the ideals of transparency, collaboration, and innovation within the field of banking was instrumental in advancing the strategic goals and objectives of the association.”

JBA said it extends its gratitude to Blake for his unwavering resolve and tireless efforts to advance the principles of financial inclusion and stakeholder engagement across the financial services landscape. His passion for promoting responsible banking practices and driving national development has left an indelible mark on us all.

“As we bid farewell, we extend our best wishes for his continued success in his future endeavours,” said the JBA.

Why are British lender Metro Bank’s shares plunging?

Mid-sized British lender Metro Bank (MTRO.L) saw its shares plunge more than 25% on Thursday following reports it is trying to raise as much as 600 million pounds ($729 million) to strengthen its capital levels.

It is another setback for the upstart lender, launched in 2010, which at one time looked like the best bet to shake up a banking market dominated by behemoths like Barclays (BARC.L), Lloyds Banking Group (LLOY.L) and NatWest (NWG.L).

WHY DOES METRO BANK NEED TO RAISE FUNDS?

Metro Bank has faced persistent struggles in recent years to convince regulators that it can use its own models when working out how much capital it needs.

The bank said in September its principal regulator had indicated more work would be needed before it could use those models in its residential mortgage business, in turn lowering capital requirements.

Sources told Reuters the bank may need 100 million pounds in additional equity.

Metro Bank also has 350 million pounds of debt maturing in 2025 which it needs to refinance soon, although the company has stressed it meets its minimum regulatory capital requirements.

Ratings agencies and analysts say any future fundraising could be expensive.

WHY IS METRO BANK DIFFERENT FROM OTHER BANKS?

Besides meeting its existing debt obligations, Metro Bank has an expensive business model to support. It is mainly funded by retail and business deposits at a time when sharply rising interest rates in the last year have pushed up deposit pricing as customers shop around for better rates.

Those pressures have raised questions about the sustainability of its high-cost, service-focused model, which includes a significant branch network.

WHO BANKS WITH METRO AND IS THEIR MONEY SAFE?

Metro Bank targets urban retail customers in British cities with outlets strategically placed in prime shopping areas.

It has also attracted business from wealthier customers through its provision of safe deposit boxes in branches, a traditional banking service that had fallen out of fashion among many rivals.

Retail depositors’ savings of up to 85,000 pounds are covered by a government guarantee in Britain, unlike the mainly business-originated deposits held by U.S. lender Silicon Valley Bank, which failed earlier this year.

HOW SIGNIFICANT IS METRO BANK IN THE UK?

With net assets of 21 billion pounds and customer deposits of 15.5 billion pounds as of June 30, Metro Bank remains a relative minnow in the UK banking market. Lloyds, for example, has more than 880 billion pounds in assets and 470 billion pounds in customer deposits.

With its network of 76 branches, which it calls stores, and ambitions to open 11 more across northern England in 2024 and 2025, Metro Bank aims to exert influence on the market beyond its size by highlighting its customer service.

It claims the longest opening hours of any high street bank, with stores typically open from 8:30 a.m. until 6:00 p.m., and from 11:00 a.m. until 5:00 p.m. at weekends, at a time when rivals have been slashing hours as well as axing branches.

ARE WE LIKELY TO SEE CONTAGION?

For now, Metro Bank’s issues are likely to be self-contained, since its idiosyncratic branch-focused, high-cost business model and issues with regulatory capital are not widely replicated across the sector.

Shares in other mid-sized British banks such as Virgin Money (VMUK.L) were flat on Thursday, indicating that investors do not see any contagion risks for now.

($1 = 0.8235 pounds)

Culled from Thomson Reuters

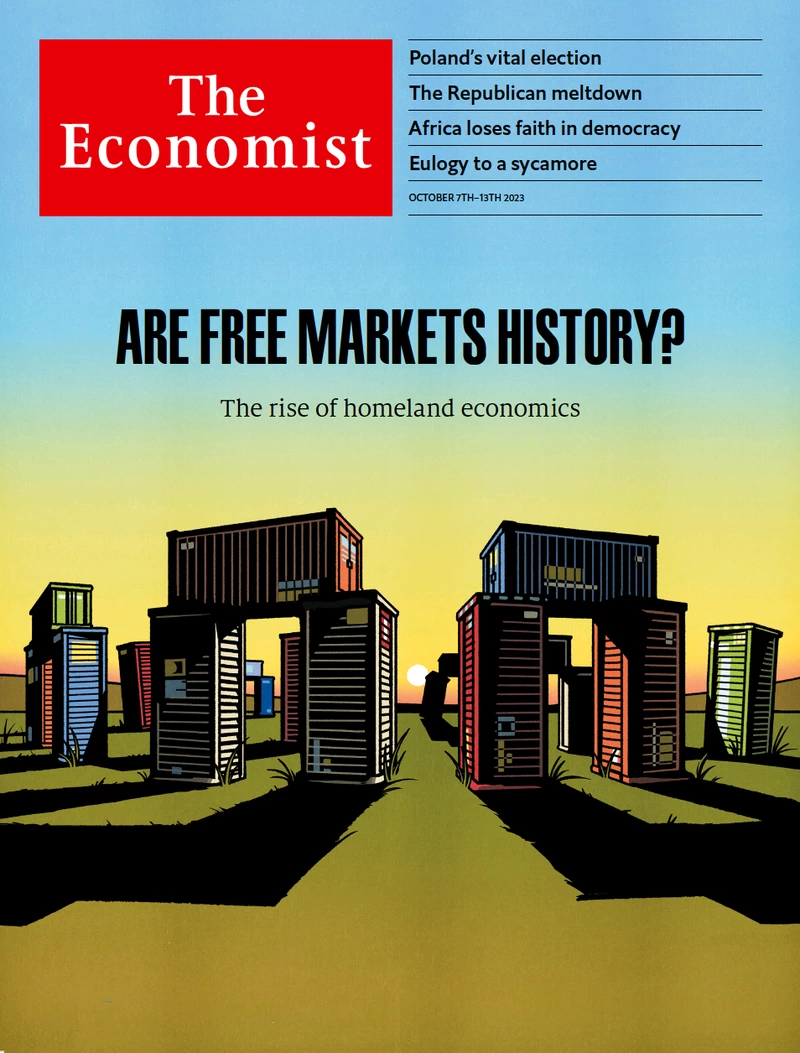

Solar industry warns of hurdles to EU’s green tech drive

Europe’s bid to expand its green tech industry faces a host of challenges, including high energy costs and supply chain issues, solar industry representatives gathered in Madrid warned on Thursday.

The comments come as the European Commission and European governments weigh tougher action on imports while aiming to boost clean tech manufacturing in Europe and reduce the reliance on China for products needed for the green transition.

“You cannot manufacture in Europe,” Gonzalo de la Vina, president for the Europe, Middle East and Africa region of Chinese solar energy firm Trina Solar (688599.SS), said at an event hosted by Spanish industry group Foro Solar.

The company has manufacturing operations in China, Vietnam and Thailand but not in Europe. It plans to invest more than $200 million to build a solar photovoltaic manufacturing facility in Texas, its first in the Western Hemisphere.

“Europe isn’t profitable,” he added.

European products are more expensive according to Christopher Atassi of Gonvarri Solar Steel, part of a Spanish industrial firm with factories around the world, including China, the United States, Spain and other European countries.

“There must be an incentive for the end customer to buy European products,” he said. “Without demand for European products, it is difficult to plan investments.”

Solar panels made in China cost as little as two-thirds of those manufactured in Europe, energy research firm Rystad Energy wrote in a July note.

Panelists said on Thursday this is due in part to higher energy and labour costs, as well as lack of competitive supply chains. For example, in the third quarter of last year, retail electricity prices paid by industrial customers in the EU were roughly twice as high as China’s, according to the European Commission.

On Wednesday, Spain’s acting Energy Minister Teresa Ribera did not rule out imposing tariffs on imports of materials used in solar power generation.

The EU gets more than 90% of its ingots and wafers for solar panels from China, according to the European Commission.

While the focus is often on China, Europe has to play catch-up with the United States, whose Inflation Reduction Act means that “the U.S. model beat Europe five to zero,” Atassi said.

“Europe had a solar panel industry, but now it is in Asia,” Juan Barandiaran of renewable energy equipment maker Gamesa Electric, a Spanish subsidiary of Germany’s Siemens Energy (ENR1n.DE) said. “It is very difficult to create it from scratch.”

Two Isrealis killed after Egyptian policeman opens fire in Alexandria

An Egyptian policeman has opened fire on tourists in the Mediterranean city of Alexandria, killing at least two Israeli nationals and one Egyptian, according to local media reports.

Extra News television channel, which has close ties to Egyptian security agencies, quoted an unidentified security official as saying that another person was wounded in the attack at an Israeli tour group in Pompey’s Pillar site in Alexandria.

The suspected assailant was detained and the site of the attack was cordoned off, according to the Extra News.

A video circulating on social media showed at least three ambulances apparently taking the victims to hospitals.

Israel’s Zaka rescue service reported two people killed in Alexandria.

Sunday’s attack came as Israel carried out bombing of Gaza Strip as it battled Hamas fighters, who killed up to 250 Israelis after crossing into Israeli territory.

At least 313 Palestinians have been killed in barrage of Israeli bombardment on Gaza Strip, which has been under an Israeli siege for the past 16 years.

Sources: Aljazeera and News Agencies

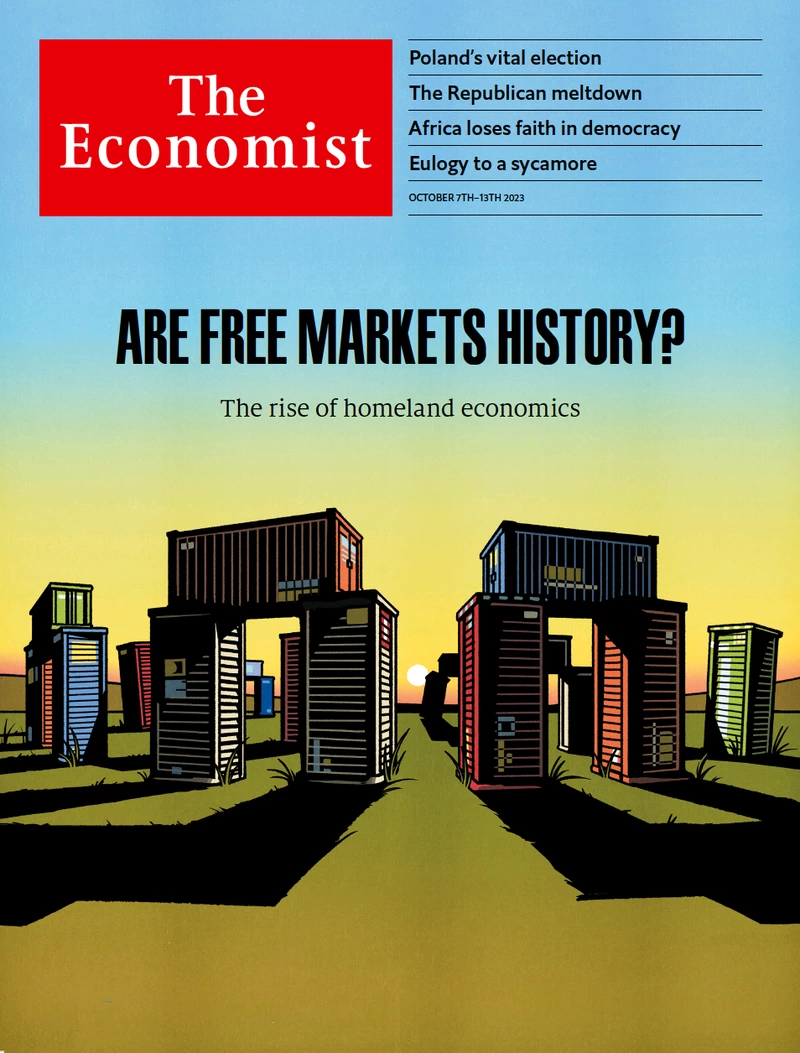

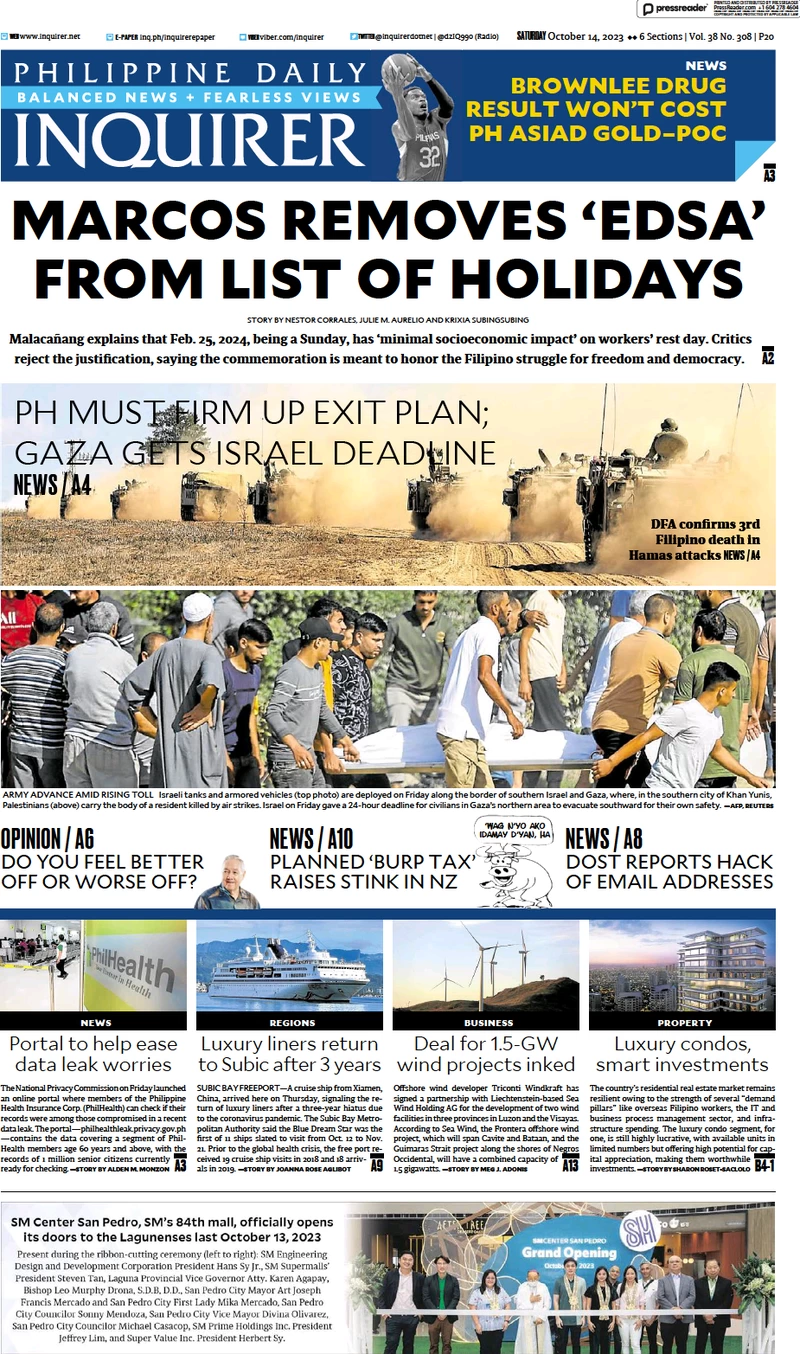

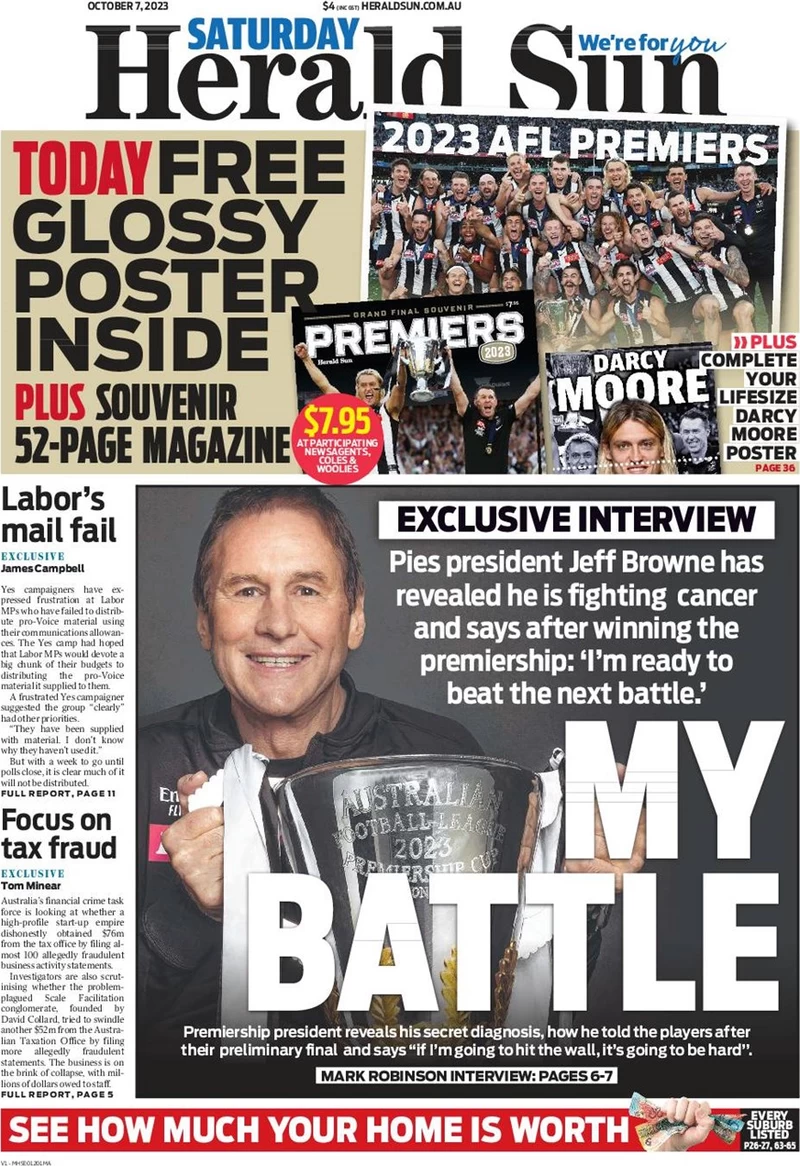

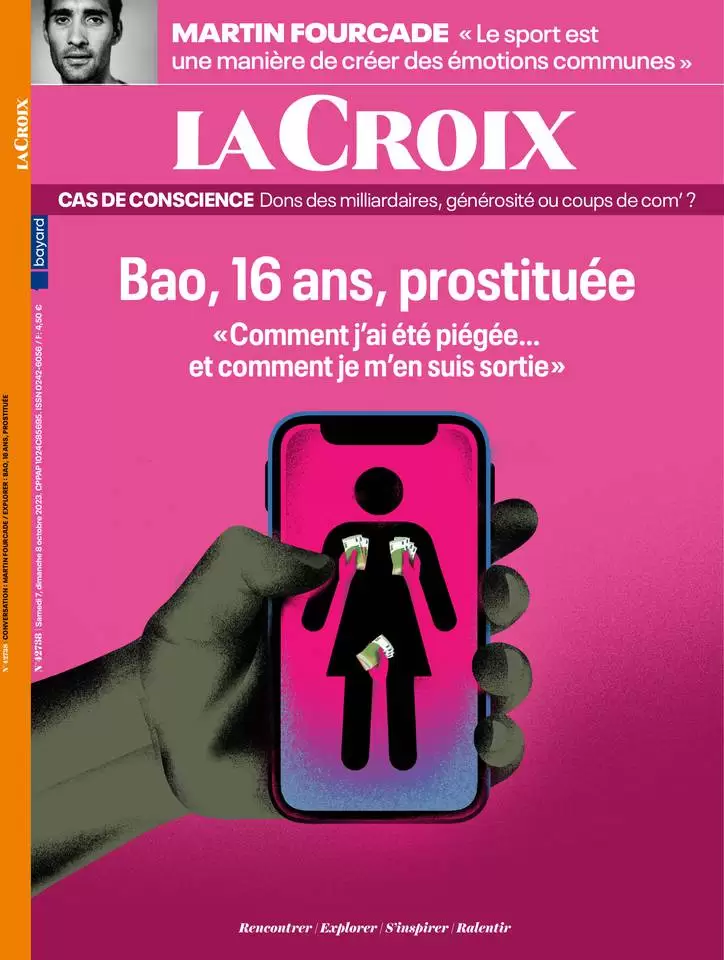

Front Pages || Saturday October 7, 2023

The inflation outlook and monetary policy in the euro area

Keynote speech by Luis de Guindos, Vice-President of the EC, at the First Annual Conference organised by the Central Bank of Cyprus

Introduction

I will start by giving you an overview of the economic outlook for the euro area before going on to look at how the ECB has adjusted its monetary policy to this outlook. I will then discuss in more detail the transmission of our monetary policy in the current environment and the sources of uncertainty that appear particularly relevant at this stage.

The outlook for inflation and growth in the euro area

Economic activity broadly stagnated over the first half of the year and is likely to remain subdued in the coming months in the Euro area. According to Luis de Guindos, Vice-President of the European Central Bank (ECB), weaker foreign demand and tight financing conditions are dampening growth, especially in the manufacturing sector.

The ECB Vice President said this, giving a speech, at the First Annual Conference organised by the Central Bank of Cyprus.

He said the services sector, which had been resilient so far, is now starting to “catch down” to manufacturing. Also, the labour market remains resilient despite the slowdown in activity, with the unemployment rate standing at its historical low of 6.4 per cent in August.

However, there are signs that labour market momentum is slowing as the economy weakens. The employment Purchasing Managers’ Index declined significantly between the second and the third quarters of 2023, despite a slight uptick in September. The services sector, which has been a major driver of employment growth since mid-2022, is now also creating fewer jobs.

In September ECB staff revised down projected GDP growth, particularly for this year and next, due to a greater contractionary effect from tightening financing conditions and the weakening international trade environment. Beyond the near term, ECB staff expect growth to recover owing to higher real disposable income thanks to rising wages and falling inflation, which is set to underpin spending. ECB staff now expect the euro area economy to expand by 0.7% in 2023, 1.0% in 2024 and 1.5% in 2025.

Inflation fell markedly from its double-digit peak last October, with the headline rate having declined to 4.3% in September (flash estimate). In the coming months, the sharp increases recorded in the autumn of 2022 will drop out of the yearly rates, lending further support to a deceleration in inflation.

At the same time, underlying price pressures remain strong, although most measures of inflation have started to ease thanks to aggregate demand and supply becoming more aligned and lower energy prices in recent months being passed on to other parts of the economy.

Labour costs are increasingly contributing to domestic inflation, while the latest data indicate that the contribution of profits fell for the first time since early 2022. Most measures of longer-term inflation expectations currently stand at around 2%, but the increase in some indicators needs to be closely monitored.

The September ECB staff macroeconomic projections see average inflation at 5.6% in 2023, 3.2% in 2024 and 2.1% in 2025. Compared with the June Eurosystem staff projections, this is an upward revision for 2023 and 2024 – which mainly reflects a higher projected path for energy prices – and a downward revision for 2025.

ECB staff have revised down slightly the projected path for inflation excluding energy and food, to an average of 5.1% in 2023, 2.9% in 2024 and 2.2% in 2025. This is on account of tighter financing conditions – which also reflect the restrictive impact of our monetary policy tightening – and a weaker economic outlook.

The ECB’s monetary policy response

In summary, while inflation continues to decline, it is still expected to remain too high for too long. The ECB is determined to ensure that inflation returns to our 2% medium-term target in a timely manner. In order to reinforce progress towards this target, we decided to raise the three key ECB interest rates by 25 basis points at the September meeting of the Governing Council.

This decision was informed by the three legs of our reaction function: first, the inflation outlook in light of the incoming economic and financial data; second, the dynamics of underlying inflation; and third, the strength of monetary policy transmission.

Having raised interest rates by a total of 450 basis points since July 2022, we consider that the key ECB interest rates have now reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to our target.

Our reaction function will continue to serve as the framework for future decisions, and we will continue to follow a data-dependent approach to determining the appropriate level and duration of a restrictive monetary policy stance.

Uncertainty regarding the transmission of monetary policy

As part of this data-dependent approach, we continually assess how monetary policy is transmitted to financing conditions, the real economy and, ultimately, to inflation. In the current hiking cycle, the first leg of monetary policy transmission – to financing conditions – has been very strong. Compared with previous hiking cycles, firms’ lending rates have increased at a faster pace and credit volumes have weakened more markedly.

Transmission to the bank lending channel is likely to continue unfolding as lenders may become more prudent in light of rising funding costs and a slowing economy. Moreover, interest rates on outstanding debt will continue to increase as loans are progressively repriced. All in all, in my view, the transmission of our policy tightening to financing conditions seems to be well underway.

The second leg of transmission relates to the way in which changes in financing conditions will affect economic activity, as firms and households adjust their plans for consumption, investment and savings accordinghe transmission of monetary policy tightening to the real economy is proceeding at a slower pace, with a substantial share of the transmission still in the pipeline.

For example, real estate activity has slowed down amid the weakening of property valuations. For the economy as a whole, model-based estimates continue to suggest that, owing to the typical lags in monetary transmission, the bulk of the impact of our tightening is expected to materialise only in the course of this year and thereafter.

The downward impact of our tightening so far on GDP and inflation is estimated to average around 2 percentage points over the 2023-25 period, with the strongest effect expected on GDP growth this year and on inflation over the next two years.

It is also worth noting that the speed of transmission varies across the euro area. In particular, the transmission to households is likely to be faster in countries where variable rate mortgages predominate over mortgages at fixed rate.

At the same time, uncertainties regarding transmission remain, mainly in relation to two sources. First, the current hiking cycle is unprecedented in speed. Moreover, it follows a long period of accommodative monetary policy and was accompanied by the recalibration of balance sheet policies, all of which limits comparability with historical regularities.

Second, the tightening of our policy stance occurred in reaction to an unprecedented constellation of shocks hitting the euro area over the last three years, which had a disruptive effect on economic conditions and the inflation environment.

The fact that we are still confronted with the overlapping legacy effects of these shocks may imply that monetary policy transmission is proceeding differently this time around compared with what historical regularities might suggest.

The euro area and the world economy are also exposed to a variety of risks that accompany this monetary policy tightening. Based on our latest assessment, risks to economic growth in the euro area are tilted to the downside. Growth could be slower if the effects of monetary policy are more forceful than expected or if the world economy weakens at a faster pace than currently projected, owing, for example, to a continued slowdown in China.

This may, in turn, dampen domestic economic activity and encourage firms, banks and households to be more cautious, thereby putting a strain on bank credit supply, investment and consumer spending. The tightening impulse may be transmitted more forcefully to the real economy in an environment of this kind owing to acceleration effects that often operate during periods of subdued growth and high uncertainty.

Conversely, growth could be higher than projected if the strong labour market, rising real incomes and receding uncertainty mean that people and businesses become more confident and spend more.

On the inflation side, weaker demand owing to the stronger transmission of monetary policy or the worsening of the international economic environment could put stronger downward pressure on prices than currently expected. Conversely, renewed upward pressures on the costs of energy and food – with oil prices having already increased in recent months – and the unfolding climate crisis could push commodity prices up by more than expected.

The role of wage dynamics and fiscal policy are of great importance in determining the future path of inflation. Wages have been catching up; elevated wage growth is therefore embedded in our projections, albeit at a decelerating pace. But a lasting increase in inflation expectations above our target owing, for instance, to higher-than-anticipated increases in wages or profit margins, could drive inflation higher, including over the medium term.

Similarly, as the energy crisis fades, governments are rolling back the fiscal support measures implemented during the crisis. But a slower rollback of this fiscal support or an expansionary fiscal policy stance in the coming years would pose significant challenges to taming inflation and bringing it back to our target.

The challenging macroeconomic environment requires a consistent mix of monetary and fiscal policies, with greater risks to price stability if these policies pull in opposite directions.

The ECB Vice President said while it is sure that monetary policy tightening is transmitted forcefully to financial markets and is increasingly leaving a footprint in the real economy, the speed and scope of the transmission remain uncertain.

This is partly due to the still-fluid economic environment in which we are navigating, with the outlook for inflation and economic activity being rendered particularly uncertain owing to both the legacy effects of previous shocks and renewed risks. In addition, the current hiking cycle is unique, with the sequence of rate hikes being unprecedented in speed.

Taking a longer-term view, structural changes in economic interactions may also exert upward pressure on inflation in a more fundamental way. At the global level, changes in trade patterns and energy markets, rising climate-related risks and the commitment to decarbonise the economy, as well as geopolitical risks, may have longer-lasting implications, which could pose greater challenges to price stability.

For these reasons, any assessment based on comparisons with historical regularities and model-based estimates must be complemented by real-time monitoring of the transmission to financial and economic conditions.

While there are signs of the strength of the first leg of the transmission, a substantial share of the transmission from financing conditions to the real economy is expected to still be in the pipeline, subject to longer lags. This reinforces the need for a data-dependent approach to determining the appropriate level and duration of a restrictive monetary policy stance.